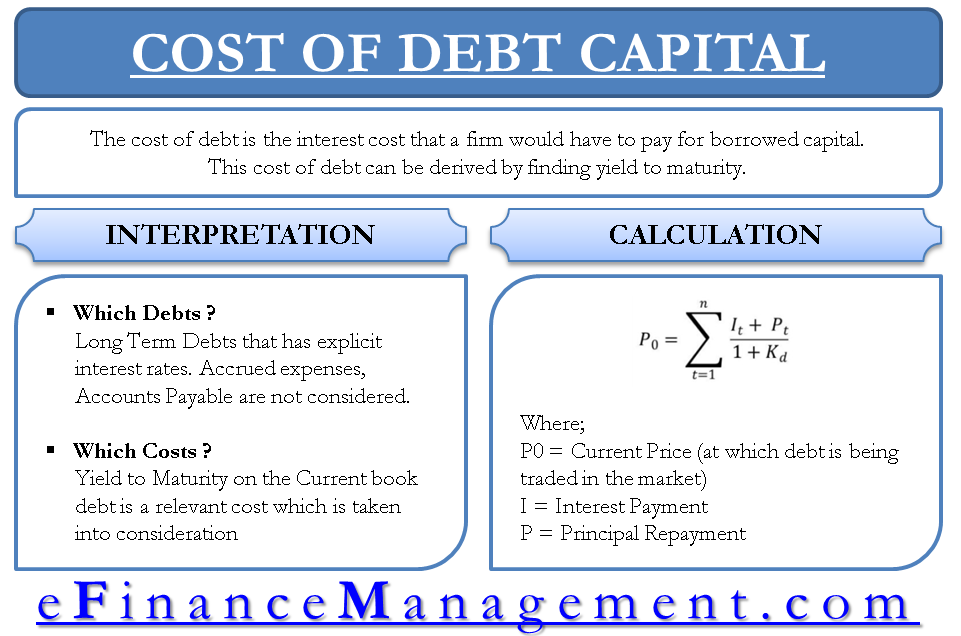

Key Concepts & Skills Calculate & explain A firm's cost of common equity capital A firm's cost of preferred stock A firm's cost of debt A firm's overall. - ppt download

The Value of Debt: How to Manage Both Sides of a Balance Sheet to Maximize Wealth: Anderson: 9781118758618: Amazon.com: Books

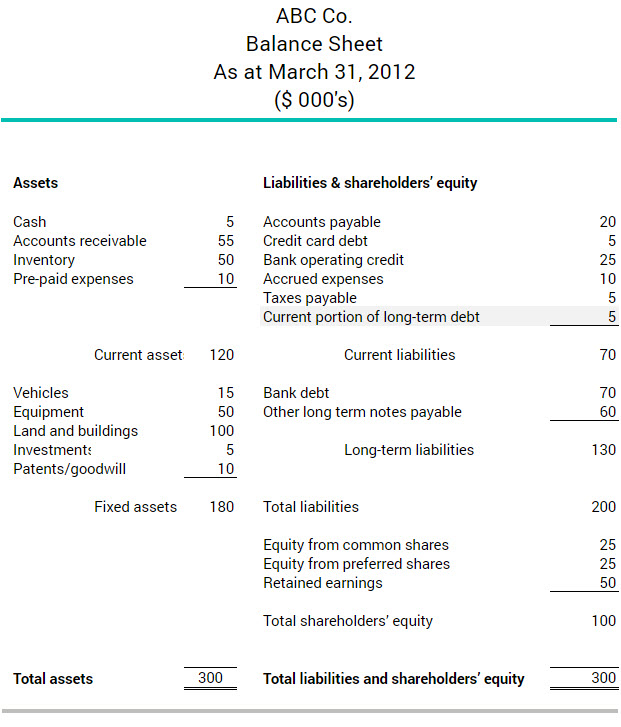

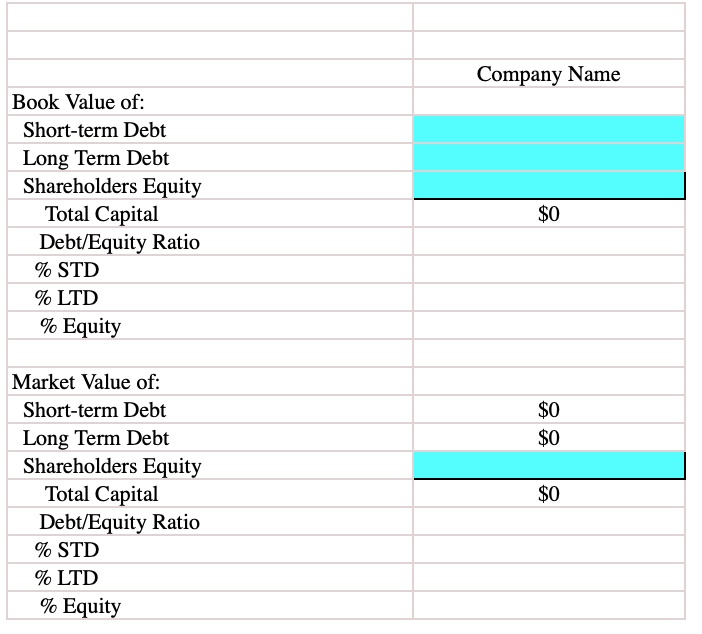

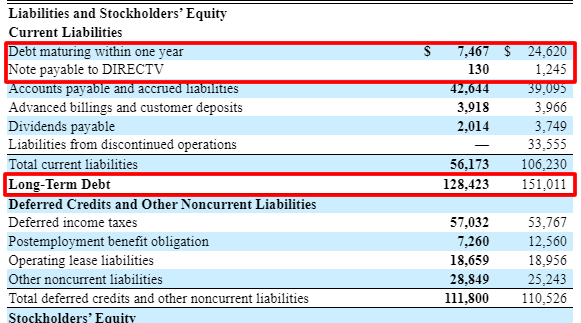

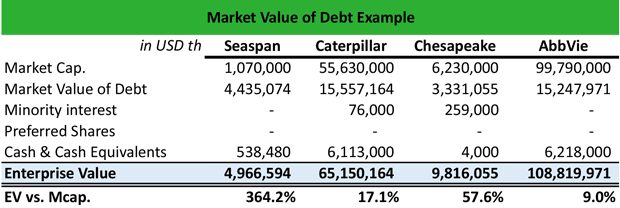

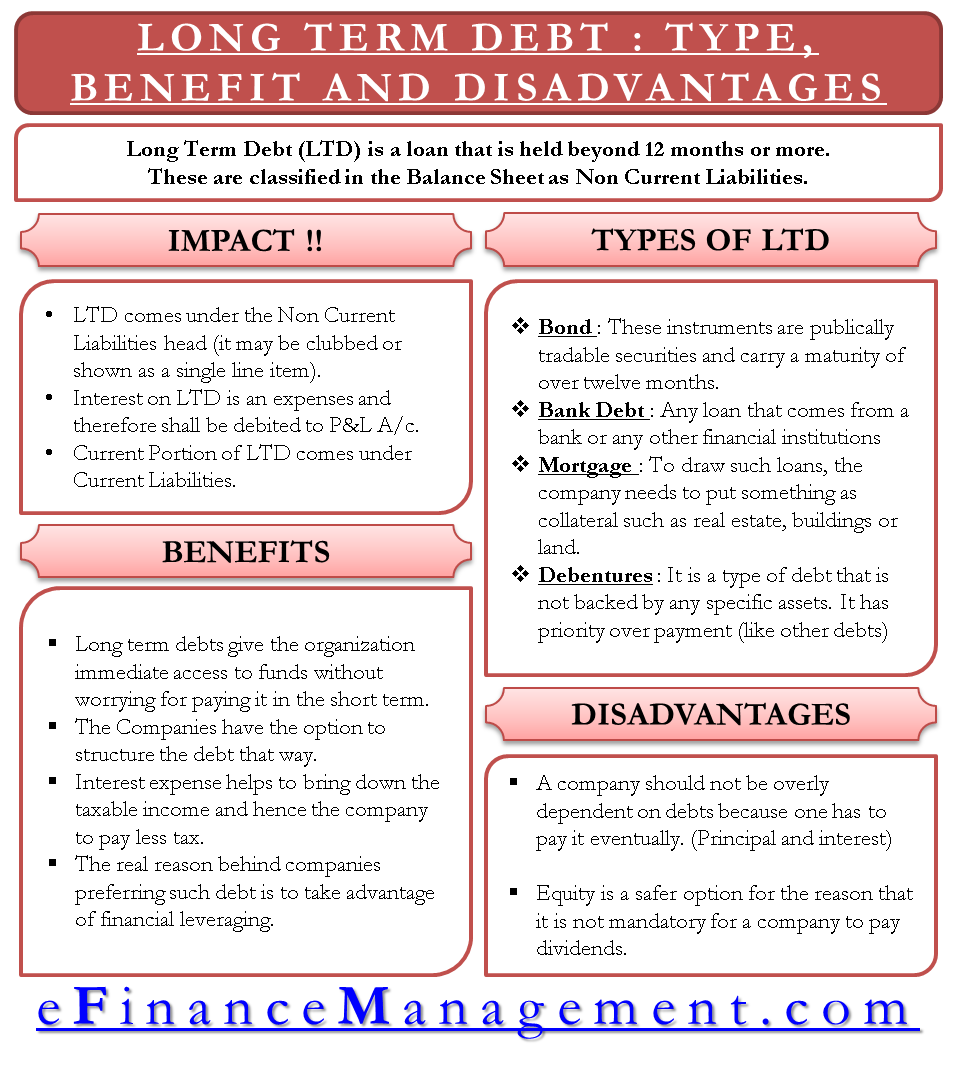

SOLVED: Capital structure is the mix of debt and equity used to finance a firm's assets. Information on a firm's financial statements, but the value of the debt and the value of

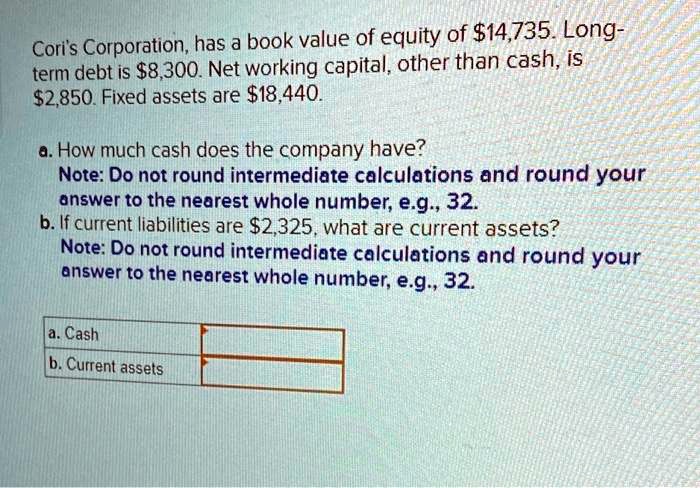

SOLVED: Cori's Corporation has a book value of equity of 14,735. Long-term debt is8,300. Net working capital, other than cash, is 2,850. Fixed assets are18,440. a. How much cash does the company

:max_bytes(150000):strip_icc()/price-to-book-ratio-bf64b6abed4d4d2292f3ab58bd55ed36.png)